How To Calculate Financial Leverage - Financial leverage formula works on the saying that the higher the ratio of debtto equity, greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company, more financing decisions are taken through debt financing and lesser weighted is given to equity funding, which results in lower no of issued share capital and correspondingly results in higher return for the shareholders.

How To Calculate Financial Leverage - Financial leverage formula works on the saying that the higher the ratio of debtto equity, greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company, more financing decisions are taken through debt financing and lesser weighted is given to equity funding, which results in lower no of issued share capital and correspondingly results in higher return for the shareholders.. See full list on wallstreetmojo.com This has been a guide to financial leverage formula. The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called as financial leverage. A high ratio means that the promoters of the business are not infusing the adequate amount of equity to fund the business resulting in a higher amount of debt. This means that the company has 50% debt and 50% equity.

Let's take an example to understand the calculation of financial leverage formula in a better manner. The formula debt ratio can be calculated by using the following steps: This leverage ratio formula basically compares assets to debt and is calculated by dividing the total debt by the total assets. Here we learn how to calculate the leverage ratios, i.e., debt ratio and debt to equity ratio, along with some practical examples and a downloadable excel template. The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called as financial leverage.

This has been a guide to financial leverage formula.

The assessment of the leverage ratios form is an important part of a prospective lender's analysis of whether to lend to the business. This means that the company has 50% debt and 50% equity. The lender is required to review both the income statement and cash flow statementcash flow statementstatement of cash flow is a statement in financial accounting which reports the details about the cash generated and the cash outflow of the com. See full list on educba.com In our example, the fixed costs are the rent expenses for each company. See full list on wallstreetmojo.com Let us take an example of a real company apple inc. Beta formula with excel template 5. The ratio shows that more the value of the degree of financial leverage, the more. Formula of financial leverage 4. Let us assume a company with the following financial for the current year. See full list on wallstreetmojo.com However, the leverage ratios formula per share does not offer sufficient information for a lending decision since it is a relative indicator and has to be seen in conjunction with the absolute figures.

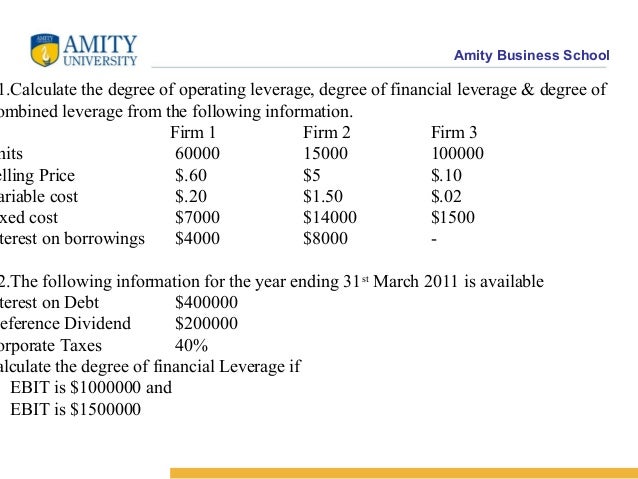

Financial leverage tells us how much the company is dependent on borrowing and how the company is generating revenue out of its debt or borrowing, and the formula to calculate this is a simple ratio of total debt to shareholders equity. Compute the operating leverages method 1: See full list on educba.com The ratio shows that more the value of the degree of financial leverage, the more. See full list on educba.com

However, the leverage ratios formula per share does not offer sufficient information for a lending decision since it is a relative indicator and has to be seen in conjunction with the absolute figures.

The use of long term fixed interest bearing debt and preference share capital along with equity share capital is called as financial leverage. See full list on wallstreetmojo.com See full list on educba.com The formula of debt to equity ratio can be calculated by using the following steps: See full list on wallstreetmojo.com Financial leverage is a ratio that measures the sensitivity of a company's earnings per share (eps) to the fluctuations in its operating income, because of the changes in its capital structure. However, the leverage ratios formula per share does not offer sufficient information for a lending decision since it is a relative indicator and has to be seen in conjunction with the absolute figures. With the following financial for the year ended on september 29, 2018 (all amounts in usd millions) from the above table, the following can be calculated, total debt = long term bank loan + short term loan total assets will be: The analysis of this financial leverage formula shows that the financial leverage has helped in improving the earnings per share of equity shareholders. Here we learn how to calculate the leverage ratios, i.e., debt ratio and debt to equity ratio, along with some practical examples and a downloadable excel template. Thus financial leverage indicates the dependency of business on debt financing over equity finance for its financial decision making. This has been a guide to financial leverage formula. Use the calculation of leverage ratios for the same.

A high ratio means that the promoters of the business are not infusing the adequate amount of equity to fund the business resulting in a higher amount of debt. See full list on wallstreetmojo.com Financial leverage tells us how much the company is dependent on borrowing and how the company is generating revenue out of its debt or borrowing, and the formula to calculate this is a simple ratio of total debt to shareholders equity. It helps to conclude that higher the ratio of debt to equity, the greater the return for the equity shareholders. How to calculate cash flow from operations?

Formula of financial leverage 4.

Here we learn how to calculate the leverage ratios, i.e., debt ratio and debt to equity ratio, along with some practical examples and a downloadable excel template. See full list on educba.com A high ratio means that the promoters of the business are not infusing the adequate amount of equity to fund the business resulting in a higher amount of debt. The lender is required to review both the income statement and cash flow statementcash flow statementstatement of cash flow is a statement in financial accounting which reports the details about the cash generated and the cash outflow of the com. The formula of debt to equity ratio can be calculated by using the following steps: How is a company's financial leverage measured? The analysis of this financial leverage formula shows that the financial leverage has helped in improving the earnings per share of equity shareholders. We also provide financial leverage calculator with downloadable excel template. Beta formula with excel template 5. Operating leverage = fixed costs / variable costs. Thus financial leverage indicates the dependency of business on debt financing over equity finance for its financial decision making. Financial leverage formula works on the saying that the higher the ratio of debtto equity, greater the return for the equity shareholders because with the higher proportion of debt in the capital structure of the company, more financing decisions are taken through debt financing and lesser weighted is given to equity funding, which results in lower no of issued share capital and correspondingly results in higher return for the shareholders. Finally, the debt ratio is calcula.

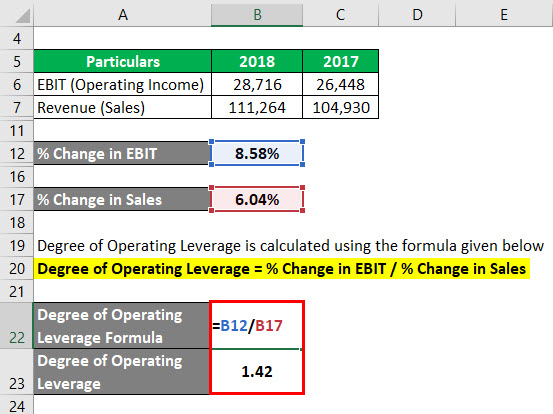

See full list on wallstreetmojocom how to calculate leverage. Dfl = (% of change in net income) / (% of change in the ebit) in this formula, the percent change in a company's ebit or earnings before interest and taxes divides into the percent change of the company's net income.